About Us

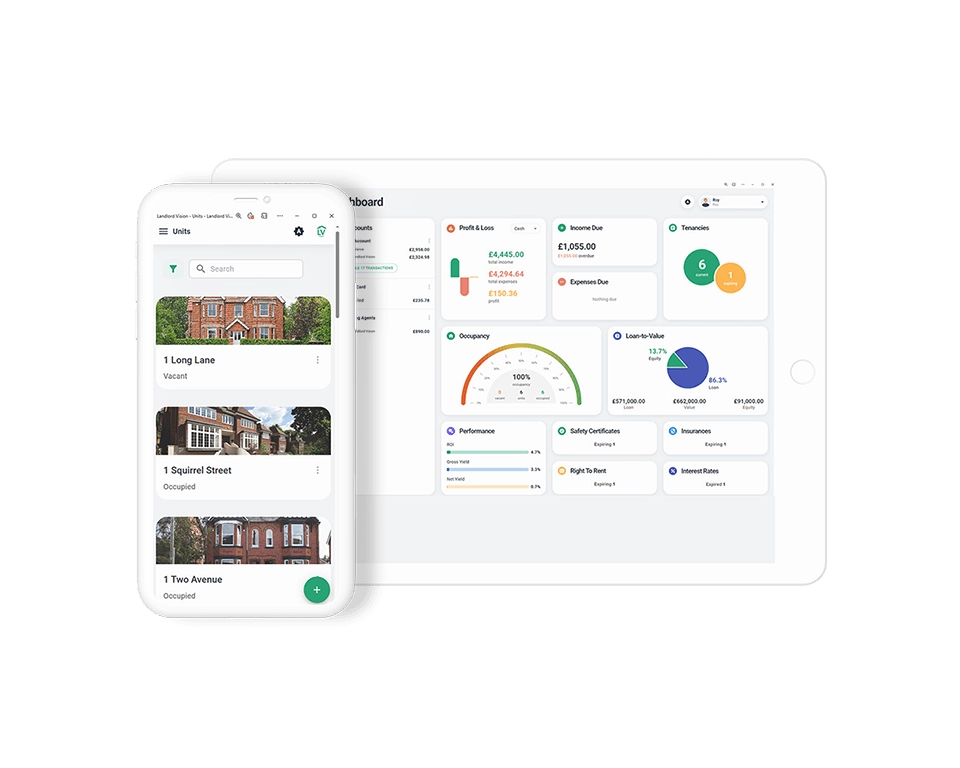

Yes. As it is an on-line solution it can be used by any device that allows access to the web, via a web browser. This includes PCs, MACs, tablets and smartphones.

No. This is because Landlord Vision has its own integrated accounting engine that has been designed by accounting experts.

We do not recommend any external parties, but we offer our own 'Managed Service', whereby a member of our team will be able to manage your portfolio on your behalf.

To learn more about this service, please contact us.

To learn more about this service, please contact us.

There is no restriction to the number of tenancies as there is a plan to suit all portfolio sizes.

With the Premium Plan you can manage up to 50 tenancies but additional packs of 50 tenancies can be purchased and bolted onto your account. For example, if you were managing 180 tenancies you would subscribe to the Premium Plan and purchase an addition 3 packs of 50 tenancies to give you a tenancy allowance of 200.

With the Premium Plan you can manage up to 50 tenancies but additional packs of 50 tenancies can be purchased and bolted onto your account. For example, if you were managing 180 tenancies you would subscribe to the Premium Plan and purchase an addition 3 packs of 50 tenancies to give you a tenancy allowance of 200.

Making Tax Digital

Making Tax Digital is a key part of the government's plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs. Some businesses are already keeping digital records and providing updates to HMRC as part of a live pilot to test and develop the Making Tax Digital service for Income Tax. You can voluntarily send Income Tax updates to HMRC instead of filing a Self Assessment tax return. Click here to learn more.

The following HMRC restrictions apply:

You can sign up for Making Tax Digital for Income Tax if all of the following is true:

• You are a UK resident

• You are registered for Self Assessment and your returns and payments are up to date

• You are a landlord who rents out UK property or a landlord and a sole trader with income from one business only *

You cannot sign up if you need to report:

• Income from any other sources

• Any taxable payments you make or that you claim tax relief on

• COVID-19 support grants (affects 2020/21 tax year only)

As HMRC adds support for tax payers with income from other sources more landlords will be able to sign up for Making Tax Digital and submit data to HMRC through Landlord Vision.

For more information, please visit the following Making Tax Digital for Income Tax page on HMRC’s website.

* Landlords with income from self-employment will need to find a separate piece of software that is compatible with Making Tax Digital for Income Tax to submit updates for self-employment to HMRC.

You can sign up for Making Tax Digital for Income Tax if all of the following is true:

• You are a UK resident

• You are registered for Self Assessment and your returns and payments are up to date

• You are a landlord who rents out UK property or a landlord and a sole trader with income from one business only *

You cannot sign up if you need to report:

• Income from any other sources

• Any taxable payments you make or that you claim tax relief on

• COVID-19 support grants (affects 2020/21 tax year only)

As HMRC adds support for tax payers with income from other sources more landlords will be able to sign up for Making Tax Digital and submit data to HMRC through Landlord Vision.

For more information, please visit the following Making Tax Digital for Income Tax page on HMRC’s website.

* Landlords with income from self-employment will need to find a separate piece of software that is compatible with Making Tax Digital for Income Tax to submit updates for self-employment to HMRC.

Yes! Landlord Vision is MTD ready. You can use the integration if you meet the current HMRC criteria. As HMRC adds support for tax payers with income from other sources, more landlords will be able to sign up for Making Tax Digital and submit data to HMRC through Landlord Vision.

Please visit our MTD FAQ page to find more answers or ask an MTD question.

Security and Data

There are three automatically executed and rotated backup slots - a daily backup, a weekly backup (2-7 day old backup) and another weekly backup (8-14 day old backup).

We have an off-site backup solution based on Amazon Glacier. The off-site backup runs daily and each backup copy is kept for 90 days before being deleted.

We have an off-site backup solution based on Amazon Glacier. The off-site backup runs daily and each backup copy is kept for 90 days before being deleted.

Other than the rights and interests expressly set forth in Landlord Vision'sTerms & Conditions, you own your data and retain all rights, title, and interest in the data you store with Landlord Vision.

Delivering expert property management solutions for companies like:

Property Management

From the main menu click on 'Portfolios', a list of portfolios is then displayed.

Then move the mouse over the name of the portfolio you want to change, a grey icon will appear to the left of the portfolio name. If you click on this you will be able 'View/Edit Portfolio'.

Then click on the 'Edit Portfolio' button and you will be able to change the portfolio name or any other details of the portfolio.

Then move the mouse over the name of the portfolio you want to change, a grey icon will appear to the left of the portfolio name. If you click on this you will be able 'View/Edit Portfolio'.

Then click on the 'Edit Portfolio' button and you will be able to change the portfolio name or any other details of the portfolio.

It is not possible to move properties from one portfolio to another, as each portfolio is treated as a separate entity. For example, when a portfolio is created, the underlying financial accounts, like the chart of accounts, bank accounts etc., could be different across portfolios and this would make the task impossible.

If you wish to move a property from one portfolio to another, this needs to be done manually by deleting it from the existing portfolio and re-creating in the new portfolio.

If you wish to move a property from one portfolio to another, this needs to be done manually by deleting it from the existing portfolio and re-creating in the new portfolio.

If you need to delete a single portfolio in its entirety, you need to go to the last stage in entering data and work backwards. For example, if your portfolio contains properties, tenancies, invoices and payments, you first need to delete the payments, then the invoices, then the tenancies, then the properties and finally the portfolio itself. This process also applies to expense invoices and payments.

If you wish to delete all of the portfolios in your database, please raise a ticket with the Landlord Vision Helpdesk and our team will do it for you.

If you wish to delete all of the portfolios in your database, please raise a ticket with the Landlord Vision Helpdesk and our team will do it for you.

Migrating Data

Landlord Vision allows you to import properties and tenancies using csv files. You can simply download our template files and then copy the data from your spreadsheets into the template and then import this file.

This will import your properties and tenancies into Landlord Vision.

This will import your properties and tenancies into Landlord Vision.

Yes, we can only import the number of tenancies that your plan allows. For example, the Free Plan will allow for three tenancies to be imported, whereas the Premium Plan will allow up to 50.

We are also the team that designed the RLA Property Manager tool for the Residential Landlords Association (RLA) and its members. We have built a migration path whereby RLA members will be able to import their data into Landlord Vision.

If you have not already done so, please upgrade your RLA Property Manager to the latest version v.3.42. The software should offer you this upgrade automatically but in case it does not you can for an update via its main menu using 'Help -> Auto Update'.

To migrate please follow the steps below:

1. First open your RLA Property Manager programme and go to:

2. 'File -> Export Properties and Tenancies to Landlord Vision'.

3. You then have a choice to only transfer active tenancies or all of your tenancies regardless of status. After the selection you will be prompted to choose a location to save the file.

4. Once saved, open up Landlord Vision. If you haven't already created your portfolio for this data, please do so by clicking on 'Portfolios -> Create Portfolio'.

5. On the Portfolio screen, click on 'Import Properties & Tenancies from CSV File'.

6. Select the Portfolio from the drop-down list and then ‘Browse' for the LPM file that you just saved.

7. Finally, click on 'Import Data'.

If you have not already done so, please upgrade your RLA Property Manager to the latest version v.3.42. The software should offer you this upgrade automatically but in case it does not you can for an update via its main menu using 'Help -> Auto Update'.

To migrate please follow the steps below:

1. First open your RLA Property Manager programme and go to:

2. 'File -> Export Properties and Tenancies to Landlord Vision'.

3. You then have a choice to only transfer active tenancies or all of your tenancies regardless of status. After the selection you will be prompted to choose a location to save the file.

4. Once saved, open up Landlord Vision. If you haven't already created your portfolio for this data, please do so by clicking on 'Portfolios -> Create Portfolio'.

5. On the Portfolio screen, click on 'Import Properties & Tenancies from CSV File'.

6. Select the Portfolio from the drop-down list and then ‘Browse' for the LPM file that you just saved.

7. Finally, click on 'Import Data'.

Try Landlord Vision now

Using Landlord Vision

Landlord Vision comes with free support including:

• Access to on-line help files

• Access to on-line video demos/tutorials

• Inbuilt support desk ticketing system

• Telephone support

• Access to on-line help files

• Access to on-line video demos/tutorials

• Inbuilt support desk ticketing system

• Telephone support

Yes, multiple users can access the software but this depends on the Landlord Vision plan you have. For example, the 'Starter' plan gives access to three users only. However the 'Standard' plan gives simultaneous access to five users and the 'Premium' plan gives access to ten users at the same time.

Yes, absolutely! A letting agent only manages certain aspects of your portfolio. Don’t forget, as a landlord you need to submit complete property accounts to HMRC at the end of the year. Here are just a few things your letting agent would not be doing for you but that Landlord Vision can:

a) Recording all of your property related expenses

b) Keeping a track of any finance i.e. mortgage/loan repayments

c) Keeping a record of all your property related documents

d) providing accurate cashflow, profit and loss and tax payment estimates

a) Recording all of your property related expenses

b) Keeping a track of any finance i.e. mortgage/loan repayments

c) Keeping a record of all your property related documents

d) providing accurate cashflow, profit and loss and tax payment estimates

Tenant Management

From the list of icons on the left hand side, click on the ‘Tenant Manager’ icon and the second tab is ‘Tenancies’ where you click on ‘Create Tenancy’.

Enter the relevant information into ‘Primary Tenant’.

If you have more than one tenant i.e. husband and wife then enter one of them into ‘Secondary Tenants’.

Assign them a property in ‘Property Details’ where you can also assign a room if the property is an HMO.

The second screen is the ‘Tenancy Details’ screen and you are able to enter information as to the ‘Start Date’; ‘Expiry Date’; ‘First Rent Due Date’; ‘Payment Term’; ‘Rent’ and ‘Deposit’.

All these fields, except ‘Deposit’, are compulsory fields which need to be completed to create the tenancy.

There is an option to place a tick in the ‘LHA Tenancy’, ‘Rolling Tenancy’ and ‘Early Warning’ fields.

Place a tick in the ‘LHA Tenancy’ and several fields are revealed. If you haven’t any Local Authorities’ details in your contacts you will need to add their details using the shortcut icon at the side of the arrow.

Otherwise if your Local Authority details are already in your contacts, click on the down arrow and select the correct one.

Select the ‘LHA Authority Payment Term’, ‘LHA Authority Rent Amount’, ‘Tenant Payment Term’, ‘Tenant Rent Amount’ and click on ‘Save’.

Enter the relevant information into ‘Primary Tenant’.

If you have more than one tenant i.e. husband and wife then enter one of them into ‘Secondary Tenants’.

Assign them a property in ‘Property Details’ where you can also assign a room if the property is an HMO.

The second screen is the ‘Tenancy Details’ screen and you are able to enter information as to the ‘Start Date’; ‘Expiry Date’; ‘First Rent Due Date’; ‘Payment Term’; ‘Rent’ and ‘Deposit’.

All these fields, except ‘Deposit’, are compulsory fields which need to be completed to create the tenancy.

There is an option to place a tick in the ‘LHA Tenancy’, ‘Rolling Tenancy’ and ‘Early Warning’ fields.

Place a tick in the ‘LHA Tenancy’ and several fields are revealed. If you haven’t any Local Authorities’ details in your contacts you will need to add their details using the shortcut icon at the side of the arrow.

Otherwise if your Local Authority details are already in your contacts, click on the down arrow and select the correct one.

Select the ‘LHA Authority Payment Term’, ‘LHA Authority Rent Amount’, ‘Tenant Payment Term’, ‘Tenant Rent Amount’ and click on ‘Save’.

Collecting Rents Via Direct Debit

Rent payments will be collected automatically so you never have to worry about missing an invoice.

Your tenants’ Direct Debits are collected by GoCardless, one of Europe’s leading Direct Debit providers based in London. They are an Authorised Payment Institution regulated by the Financial Conduct Authority and a Bacs-approved bureau.

Funds that have been collected for you are paid directly into your UK bank account. The amount transferred will be the total amount collected minus the fees, and will be paid into your account two working days from when a payment was collected.

For each rent collected, the following fees are deducted:

Landlord Vision Fee: 0.75% of transaction amount (capped at £2) + VAT

GoCardless Fee: 0.80% of transaction amount (capped at £1.60) + VAT

This means that the maximum amount that will be charged for a direct debit collection will be £4.32

Landlord Vision Fee: 0.75% of transaction amount (capped at £2) + VAT

GoCardless Fee: 0.80% of transaction amount (capped at £1.60) + VAT

This means that the maximum amount that will be charged for a direct debit collection will be £4.32

Yes, you will be notified via email from GoCardless.

When you enabled the Direct Debit facility in Landlord Vision, a GoCardless account was created for you. Simply log into your GoCardless account to edit or amend your details.

At present only UK Direct Debit-enabled bank accounts.

Setting up a Direct Debit for your tenant is done from within Landlord Vision. Please see our video tutorial on setting up Direct Debits.

No. Due to strict rules around Direct Debit, only the account holder (in this case your tenant) can set up the Direct Debit Instruction.

On your tenant’s bank statement your name will show as the reference and GoCardless as the recipient.

When completing their Direct Debit authorisation form, your tenants will create a GoCardless account. Once created, they can log in to view their dashboard, including details of all their transactions, at any time.

When completing their Direct Debit authorisation form, your tenant will create a GoCardless account. Once created, they can then log in to their GoCardless account to update or amend their details.

When the Direct Debit mandate is created it will take four working days for the first payment to be submitted to BACS. Subsequent recurring payments will be submitted to BACS on each rent due date. If the rent due date falls on a weekend or bank holiday, the payment will be submitted to BACS on the last working day prior to the rent due date.

If the rent amount changes then you need to cancel the existing Direct Debit in Landlord Vision, edit the tenancy to increase or decrease the amount and then request a new Direct Debit.

Please see our video tutorial on how to cancel a Direct Debit.

GoCardless will send you an email notifying you of the cancellation.